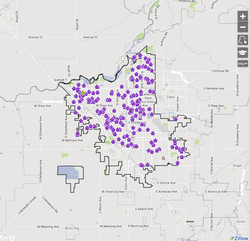

Beginning next week, the city of Fresno will mail letters to all rental properties within the city limits asking that they register their properties within 30 days. This can be done online at fresno.gov/rentalhousing or via a form included with the letter.

The registry is part of the Rental Housing Improvement Act, or RHIA. Mayor Lee Brand wrote the ordinance, taking into account the concerns of the California Apartment Association.

FRESNO MAYOR LEE BRAND

“I made a promise to the people of Fresno to dramatically improve our housing stock and substantially reduce substandard housing,” Brand said in this Fresno Bee article about the program launch. “I’m especially proud of the finished product because it’s one of the most ambitious things the city has ever done.”

In addition to a free rental registry, the ordinance includes a percentage-based sample interior inspection program to ensure compliance with state housing law. Properties that pass inspection would then be allowed to self-certify.

The city has a dedicated help line for any questions: (559) 621-RENT. (7368). Rental owners are urged to take a moment to register their property or properties; the process is free and user-friendly.

The city will also be holding a workshop on the RHIA from 10 a.m. to noon on Tuesday, Jan. 23, at City Hall, 2600 Fresno St. The workshop will be held in council chambers and include a discussion and question-and-answer session.

Please contact Franklin Spees with Neighborhood Property Management for additional information or questions.

RSS Feed

RSS Feed